|

|

|

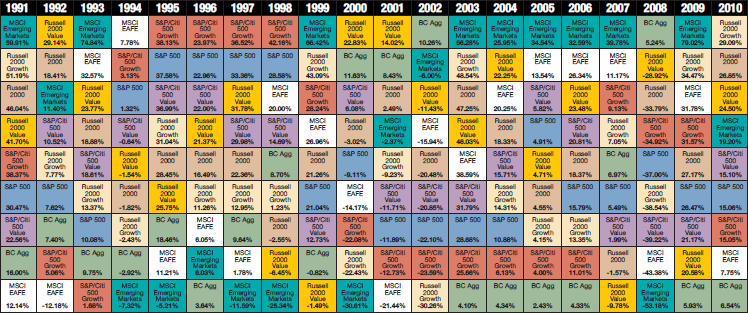

Markets Rotate: Does Your Portfolio Adapt?

Any advanced risk management system for investing has to meet a critical challenge: markets constantly rotate. Just as an

investor implements a stock & bond portfolio, markets become volatile and gold has now risen into favor over equities. Technology is

hot, then takes a back seat to real estate. On the international front, China gives way to Brazil and India - and cycles back again.

Last quarter's top performers become today's laggards.

It's called "market rotation", or "money flow" and it occurs constantly within the market's styles, sectors, and international

regions, driven simultaneously by changes in economic, financial and political climates around the world. Along with fast-moving

markets and endless alternatives, these rotations present you with daunting choices.

|

|

|

Which markets should you...

how much should you own...

based on current risk in the market:

The list of choices is endless and constantly rotating based on

global money flow. This presents investors with constant

emotional choices as to where best place their personal assets

for the best risk adjusted return.

|

|

• Equities or Fixed Income?

• Technology or real estate?

• Asia or Europe?

• Emerging or Developed Markets?

• Equities or Europe?

• Gold or Agriculture Commodities?

• Consumer Services or Healthcare?

|

|

|

Should you own some of each? When should you rebalance?

How you allocate among these and other choices may determine up to 90% of your portfolio's performance, according

to Nobel prize-winning economists. We believe keeping your portfolio current with market trends and attempting to

reduce large losses in your portfolio during severe market downside volatility is the best way to manage risk and return

over the long term.

|

|

The Callan Periodic Table of Investment Returns

Annual Returns for Key Indices (1991-2010) Ranked in Order of Performance

|

|

|

|

|