|

|

| |

|

Strategically Diversify to Actively Manage Risk

Unlike buy and hold or fixed asset allocation

strategies, CIM's approach is flexible and dynamically

adjusts portfolio risk to meet current market

conditions. The approach seeks the most

favorable investment opportunities and attempts to

reduce risk when the markets become unstable.

CIM uses a proprietary tool called the Risk Adjusted

Performance Ratio (RAPR™) to adjust portfolio

allocations and risk exposures to changes in the

market environment.

|

|

|

|

|

|

|

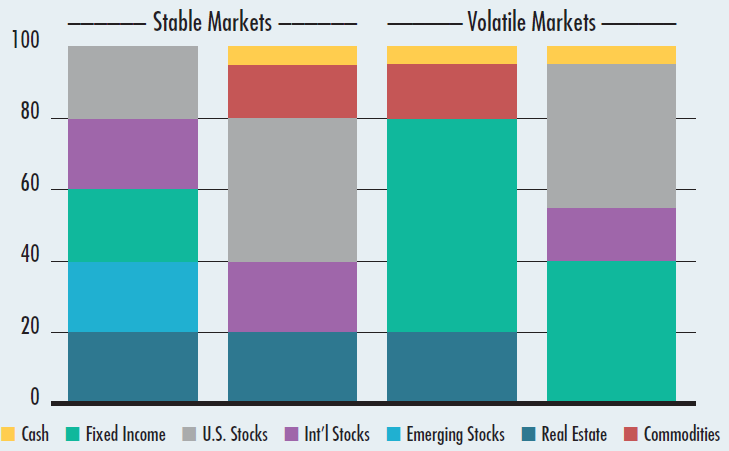

As shown in the graph below, CIM's Dynamic Asset Allocation method is flexible and

adapts to changing market conditions. If the RAPR signals that there is significant

instability in the U.S. stock market, the InvestFlex™ Strategies may lower risk by

reducing its allocations to U.S. stocks and increase allocation to traditionally less risky

assets such as cash and fixed income. Alternatively, the RAPR may signal more

favorable opportunity outside U.S. stocks and increase allocations to asset classes such

as international stocks, emerging market stocks, real estate or commodities.

|

|

|

|

The hypothetical allocations shown above are for illustrative purposes only intended to

demonstrate the potential benefit of implementing a dynamic allocation strategy.

|

|

|