|

|

|

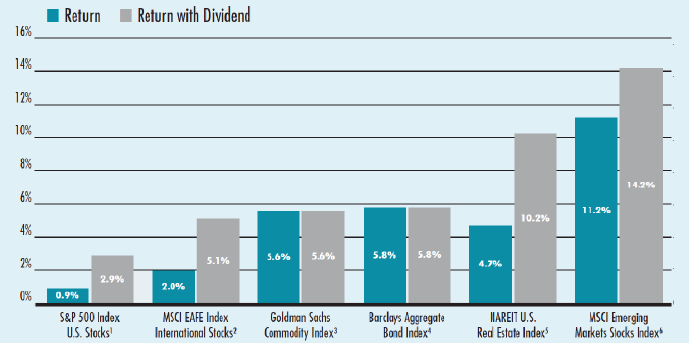

Seek Opportunity Beyond U.S. Stocks and Bonds

INVESTORS need to seek the most favorable opportunities

amongst a broad range of diversified investments.

Greater risk adjusted performance may be obtained by incorporating low-correlated

asset classes or investments into a traditional stock and bond portfolio.

FACT: The 10-year period from 2001-2011 included a technology & real estate bubble, the U.S.

credit & housing crisis, domestic banking troubles & the European debt crisis, the U.S.

stock market as measured by the S&P 500 Index significantly underperformed other

markets and asset classes.

During this same 10-year period, investment returns would have significantly

improved if portfolios were diversified beyond just U.S. stocks to include asset classes

such as international stocks, emerging market stocks, real estate and commodities.

10 Year Annualized Returns for Market Indices

The above chart measures 10 year annualized returns through December 31, 2011. Past performance

is not necessarily indicative of future results. Additional disclosures may be found on the Disclaimer

page of this website.

|

|

|