|

Strategically Diversify to Reduce Portfolio Risk

INVESTORS need to reduce the risk of losing significant value

during volatile market periods.

Investors may achieve greater long term performance with less risk by reducing the

negative impact of low performing investments during volatile and unstable market

environments.

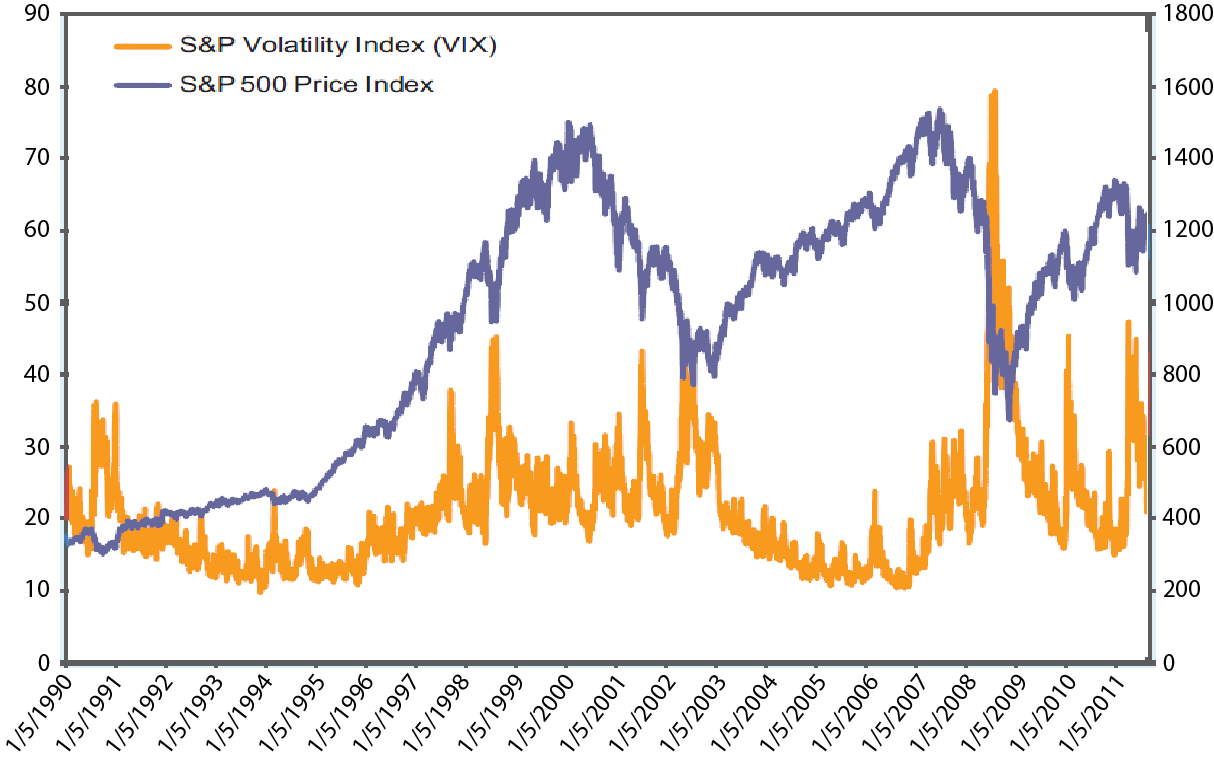

FACT: During the 10-year period from 1999 - 2009, when stock market volatility increased the value of most

stocks decreased and portfolios utilizing a buy and hold or fixed allocation strategy

experienced significant losses.

Portfolio's employing a flexible or dynamic allocation strategy may have reduced

large losses during unstable market environments by strategically diversifying and

repositioning portfolio risk allocations to investments reacting more favorably.

Stock Market Growth (S&P 5001) vs. Stock Market Volatility (VIX7)

The above chart shows stock market growth vs. stock market volatility from January 1990 through December 31, 2011.

Past performance is not necessarily indicative of future results. Additional disclosures may be found on the Disclaimer

page of this website.

|